Fomc Meeting Times Dates Schedule And What To Watch For

Lead: The Federal Open Market Committee (FOMC) plays a pivotal role in shaping the economic landscape of the United States. Its periodic meetings are closely watched by investors, economists, and policymakers alike, as they often dictate the direction of interest rates, inflation, and overall economic growth. Understanding the FOMC meeting times, dates, schedule, and what to watch for is crucial for anyone seeking to comprehend the forces driving market movements and economic policy. This guide provides a comprehensive overview of these essential gatherings, explaining their significance and highlighting the key elements that typically emerge from their deliberations.

What Is the FOMC Meeting Times, Dates, Schedule, and What to Watch For?

The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Federal Reserve System. It comprises twelve members: the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and presidents of four other Federal Reserve Banks on a rotating basis. The FOMC is primarily responsible for open market operations, which involve buying and selling U.S. government securities in the open market to influence the federal funds rate and, consequently, other interest rates in the economy.

The FOMC meeting times, dates, schedule, and what to watch for collectively refer to the established timetable of these critical gatherings and the key economic indicators, policy decisions, and forward guidance that market participants scrutinize. The committee meets regularly to assess economic and financial conditions, deliberate on appropriate monetary policy, and make decisions regarding:

- The target for the federal funds rate.

- Changes to other policy tools, such as quantitative easing or tightening.

- Economic projections and outlooks.

Why the FOMC Meeting Times, Dates, Schedule, and What to Watch For Is Trending

Interest in the FOMC meeting times, dates, schedule, and what to watch for remains consistently high because the committee's decisions have profound and immediate effects across various sectors. In an era of evolving economic challengesfrom inflation concerns to labor market dynamics and global geopolitical eventsthe Fed's actions are more scrutinized than ever. Every announcement, statement, and nuance from an FOMC meeting can trigger significant shifts in stock markets, bond yields, currency values, and consumer sentiment. This continuous relevance makes information about the FOMC schedule and potential outcomes a perennial "trending" topic in financial news. The impact extends beyond Wall Street, influencing everything from mortgage rates for homebuyers to borrowing costs for businesses, making it a topic of broad public interest.

Dates, Locations, or Key Details

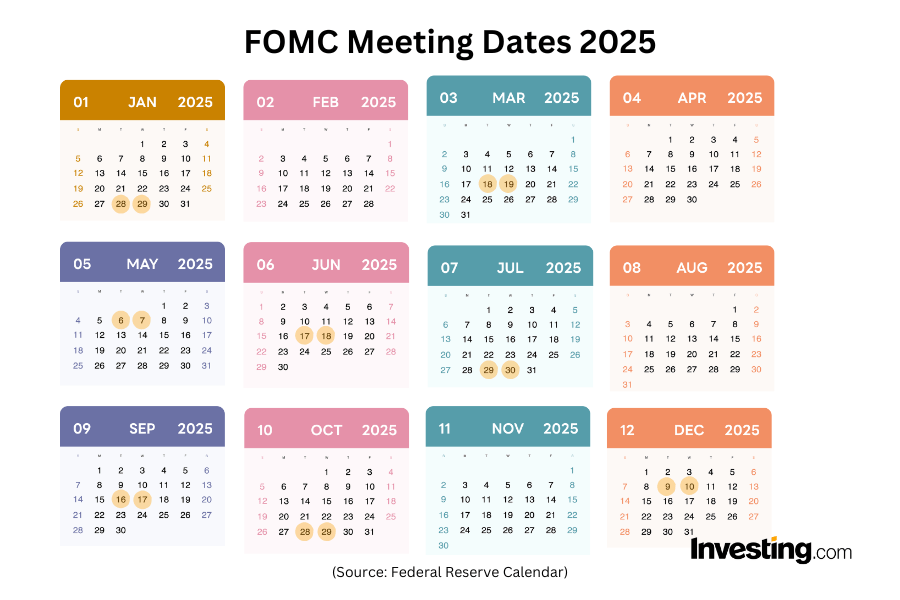

The FOMC typically holds eight regularly scheduled meetings per year, approximately every six weeks. These meetings usually last two days, with the policy decision announced on the second day. The specific FOMC meeting times, dates, schedule, and what to watch for are publicly available well in advance, usually for several years into the future. While the meetings are held in Washington, D.C., the decisions and statements are disseminated globally.

Key details to note for each meeting include:

- Meeting Schedule: A calendar of upcoming meetings is published on the Federal Reserve Board's website. These dates are firm, though unscheduled meetings can occur in emergencies.

- Policy Statement: Released at 2:00 p.m. ET on the second day of most meetings, this statement outlines the committee's decision on the federal funds rate and provides an assessment of economic conditions.

- "Dot Plot" (Summary of Economic Projections): Released quarterly (March, June, September, December), this includes individual FOMC members' projections for GDP growth, unemployment, inflation, and the federal funds rate over the next few years and in the longer run.

- Press Conference: Following the release of the policy statement and "dot plot" (for quarterly meetings), the Fed Chair holds a press conference at 2:30 p.m. ET to elaborate on the committee's decisions and answer questions from journalists.

- Meeting Minutes: Released three weeks after each meeting, these provide a more detailed account of the discussions among committee members, offering further insight into their economic outlook and policy considerations.

These documents and events form a comprehensive guide for anyone tracking the Federal Reserve's monetary policy trajectory.

How To Get Involved or Access FOMC Meeting Information

Direct involvement in the FOMC meetings themselves is limited to committee members and designated staff. However, accessing and understanding the information released by the FOMC is highly accessible to the public. To stay informed about the FOMC meeting times, dates, schedule, and what to watch for, individuals can follow these practical steps:

- Consult the Official Federal Reserve Website: The primary source for all FOMC-related information is the Board of Governors of the Federal Reserve System website (www.federalreserve.gov). The site hosts the official meeting calendar, policy statements, minutes, economic projections, and transcripts.

- Follow Live Press Conferences: The Fed Chair's press conferences are webcast live on the Federal Reserve's website and often carried by major financial news networks (e.g., CNBC, Bloomberg TV).

- Subscribe to News Alerts: Many financial news organizations offer email or app notifications for key economic data releases and FOMC announcements.

- Read Post-Meeting Analysis: After each meeting, financial journalists and economists provide extensive analysis of the decisions and their potential implications. Reputable sources like The Wall Street Journal, Bloomberg, and Reuters offer timely insights.

- Engage with Economic Commentators: Follow economists and market strategists on platforms that provide expert commentary and interpretation of FOMC actions.

What To Expect

- Interest Rate Decisions: The most anticipated outcome, impacting borrowing costs for consumers and businesses alike.

- Economic Forecasts: Updates to the Fed's projections for inflation, unemployment, and GDP growth, offering insight into its economic outlook.

- Forward Guidance: Clues about the future path of monetary policy, indicating how the Fed might react to changing economic conditions.

- Market Volatility: Often accompanies the release of FOMC statements and press conferences as markets react to new information.

The Broader Impact of FOMC Decisions

The implications of the FOMC meeting times, dates, schedule, and what to watch for extend far beyond financial trading screens. Monetary policy decisions ripple through the entire economy, affecting:

- Consumer Spending: Higher interest rates can make borrowing for homes, cars, and credit cards more expensive, potentially dampening consumer demand. Lower rates can stimulate spending.

- Business Investment: Companies rely on borrowing for expansion and investment. The cost of capital, influenced by Fed rates, can dictate growth plans, hiring, and innovation.

- International Trade and Currency: Interest rate differentials can influence the strength of the U.S. dollar, affecting the cost of imports and exports, and the competitiveness of American goods abroad.

- Inflation: The Fed's primary mandate is to maintain price stability. Its actions are a crucial tool in either cooling an overheating economy to curb inflation or stimulating a sluggish one to avoid deflation.

The Federal Reserves communication strategy is just as critical as its policy decisions. The market often moves on expectations, and clear guidance from the FOMC is essential for stability and predictability, notes a prominent market strategist.

Economic or Social Insights

The FOMC's influence is a cornerstone of economic stability. For instance, during periods of economic uncertainty, the FOMC's commitment to injecting liquidity or signaling prolonged low interest rates can act as a significant psychological and practical boost to markets and businesses. Conversely, a hawkish shift in policy can signal the Feds concern about rising inflation, leading to investor apprehension. Insights from analyses in publications such as Bloomberg and The Wall Street Journal frequently highlight how the nuances of FOMC statements are dissected for signs of consensus or divergence among members, which can hint at future policy directions. The social impact is also palpable, as changes in interest rates directly affect the affordability of housing, education loans, and consumer credit, touching the lives of everyday Americans.

Frequently Asked Questions About FOMC Meeting Times, Dates, Schedule, and What to Watch For

- What is FOMC meeting times dates schedule and what to watch for? This refers to the planned calendar of meetings by the Federal Open Market Committee, the primary monetary policymaking body of the U.S. Federal Reserve, and the critical economic indicators and policy announcements that are scrutinized during and after these gatherings.

- Why is FOMC meeting times dates schedule and what to watch for popular? It is popular because the FOMC's decisions directly influence interest rates, inflation, and the overall health of the U.S. economy, impacting everything from investment returns to consumer borrowing costs. Its continuous relevance makes it a constant focal point for financial news and analysis.

- How can people participate or experience it? While direct participation in the meetings is not possible for the public, individuals can "experience" it by closely following official announcements from the Federal Reserve website, watching live press conferences, reading expert analysis from financial news outlets, and tracking market reactions.

- Is it legitimate or official? Yes, the FOMC meeting times, dates, schedule, and all associated announcements are entirely legitimate and official, coming directly from the Board of Governors of the Federal Reserve System, an independent agency of the U.S. federal government.

- What can attendees or users expect? Observers can expect comprehensive policy statements, economic projections, detailed meeting minutes, and press conferences that provide insights into the Federal Reserve's current economic assessment and future monetary policy direction, often leading to market movements.

Conclusion

Understanding the FOMC meeting times, dates, schedule, and what to watch for is indispensable for anyone navigating the U.S. economic landscape. These regular gatherings are not merely bureaucratic formalities; they are pivotal events that shape financial conditions, influence business decisions, and impact the financial well-being of millions. By staying informed about the Fed's calendar and the critical details released from its meetings, individuals can gain valuable insights into the forces driving the economy and make more informed financial decisions.